Offshore Company Formation for Confidentiality and Financial Freedom

Offshore Company Formation for Confidentiality and Financial Freedom

Blog Article

Browsing the World of International Business: Insights on Offshore Company Formation

Offshore Company Formation offers a tactical method for global business procedures. It offers noteworthy benefits, such as tax optimization and improved personal privacy. The procedure is not without its obstacles. Recognizing the intricacies of regulatory needs and different territories is vital. As organizations consider these choices, the steps included can greatly influence their long-term success. What are the vital variables that can cause reliable overseas administration?

Understanding Offshore Companies: Definition and Objective

Offshore firms have actually come to be a prime focus in global organization discussions because of their special legal and financial structures. These entities are established in jurisdictions beyond the owner's nation of residence, commonly with positive regulatory environments. Usually, overseas companies serve numerous objectives, such as asset security, tax obligation optimization, and boosted personal privacy. They can run in multiple markets including technology, finance, and profession, giving adaptability for international operations.The specifying attribute of an offshore Company is its capacity to perform organization internationally while taking advantage of decreased tax obligation liabilities and governing concerns. This framework attract capitalists and business owners looking for to diversify their portfolios and take care of dangers properly. Additionally, numerous overseas jurisdictions use incentives to attract foreign investment, leading to a boost in the Formation of these companies. Comprehending the definition and purpose of overseas business is vital for navigating through the intricacies of global business and resources flow.

Key Benefits of Offshore Company Formation

The Formation of an offshore Company uses numerous compelling benefits that attract investors and entrepreneurs alike. Among the main advantages is tax obligation optimization; lots of jurisdictions provide beneficial tax rates or exceptions, permitting services to take full advantage of revenues. In addition, offshore firms usually delight in greater privacy, as lots of jurisdictions have strict privacy laws safeguarding the identities of Company proprietors and shareholders.Another considerable advantage is asset defense. Offshore entities can safeguard assets from political instability and financial recessions in the proprietor's home country. These companies can help with worldwide profession, supplying very easy accessibility to international markets and simplifying cross-border transactions.The versatility in company framework additionally charms to service proprietors, as offshore business can be customized to meet particular functional demands. In general, the critical Formation of an offshore Company can result in enhanced financial safety and security, operational efficiency, and a durable international presence.

Common Challenges in Developing Offshore Entities

Establishing offshore entities offers several obstacles that businesses must browse. Trick issues consist of regulative compliance, which can vary considerably throughout jurisdictions, and the influence of social differences on procedures. In addition, organizations must consider the expenses and dangers connected with maintaining an overseas existence, which can affect overall viability.

Regulative Conformity Issues

Navigating regulatory compliance issues presents considerable obstacles for organizations when they seek to establish overseas entities. Each jurisdiction has its own set of laws and guidelines, which can differ commonly and may be challenging to navigate. Firms typically deal with obstacles pertaining to tax compliance, anti-money laundering laws, and coverage requirements. In addition, modifications in international tax regulations can create uncertainty, making it essential for companies to stay updated on compliance commitments. Failing to abide by these policies can cause extreme penalties, consisting of penalties and reputational damages. Comprehending the legal structure and involving with neighborhood professionals is necessary for effective overseas operations, making sure that organizations can operate within the boundaries of the legislation while optimizing their international method.

Social Differences Impact

Cost Factors To Consider and Dangers

Guiding through the economic landscape of overseas entity Formation offers numerous cost considerations and intrinsic threats. Preliminary setup prices commonly include lawful costs, registration costs, and conformity fees, which can gather considerably. Additionally, recurring maintenance expenditures such as annual costs and accountancy services must be factored in. In addition, varying regulative settings in various territories posture threats, potentially bring about unexpected expenses or lawful difficulties. Organizations may likewise experience difficulties connected to taxation, banking, and reputational concerns, which can impact profitability and operational performance. Potential business owners have to conduct detailed due persistance and monetary projecting to alleviate these dangers and guarantee sustainable development. Comprehending these cost factors to consider is vital for effective overseas service endeavors.

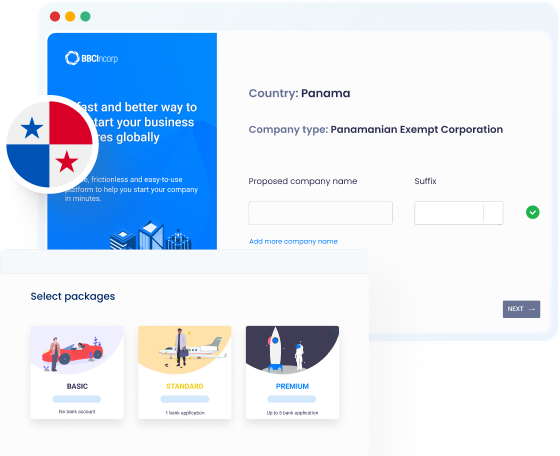

Actions to Set Up an Offshore Company

Establishing an overseas Company includes a number of vital actions that need cautious consideration. Trick elements consist of selecting the ideal territory and ensuring conformity with neighborhood guidelines, together with gathering necessary paperwork. Comprehending these aspects is vital for a successful overseas company configuration.

Picking the Right Territory

Choosing the appropriate jurisdiction is crucial for any individual looking to establish an offshore Company, as it can considerably influence the organization's legal commitments, tax obligation obligations, and operational convenience. Numerous factors must be thought about, consisting of the political stability, regulative environment, and tax incentives supplied by potential territories. Popular selections commonly consist of nations with favorable tax regimes, such as the British Virgin Islands or Cayman Islands, due to their reduced or no tax rates. Additionally, the ease of operating and the reputation of the jurisdiction can affect financier confidence and market gain access to. Eventually, a well-informed choice based on comprehensive research study will certainly guarantee the overseas Company is positioned for lasting success and compliance with international requirements.

Called For Paperwork and Compliance

When establishing up an offshore Company, comprehending the essential documentation and conformity requirements is vital to guarantee a smooth procedure. Secret records typically include a certificate of consolidation, a memorandum and write-ups of organization, and proof of identification for investors and supervisors. Some territories might call for additional information, such as service plans or bank recommendations. Conformity with regional regulations is essential, which commonly entails selecting a signed up agent and keeping an authorized office. Routine reporting and adherence to tax commitments should also be thought about. Failing to follow these demands can cause charges or even dissolution of the Company. Thorough preparation and consultation with legal professionals can assist browse these complexities properly.

Picking the Right Jurisdiction for Your Offshore Company

How can one determine one of the most appropriate territory for an overseas Company? Choosing the best jurisdiction requires careful factor to consider of multiple variables. The legal and tax setting plays a crucial function; territories with positive tax regimens may improve organization earnings. Furthermore, the political stability and financial climate of an area can influence long-term service viability.Another important aspect is the availability of economic services and banking framework, which assist in smooth procedures. Potential service owners should also take into consideration the ease of working, including the speed of enrollment and the clarity of regulations.Furthermore, language obstacles and social distinctions can influence operations; for that reason, aligning with a jurisdiction that aligns with company goals and personal comfort is important. Eventually, thorough research study and expert advice can assist business owners in making an informed choice that lines up with their critical goals.

Compliance and Governing Considerations

Best Practices for Managing an Offshore Organization

Taking care of an offshore organization needs critical planning and meticulous execution to enhance efficiency and minimize threats. Initially, establishing a durable conformity framework is necessary to browse varying regulations throughout territories. Routine audits and risk assessments assist determine potential vulnerabilities.Moreover, leveraging regional proficiency via partnerships with regional experts can boost operational effectiveness and cultural understanding. Using technology, such as cloud-based management systems, streamlines communication and information monitoring, making it possible for much better decision-making. Additionally, maintaining clear monetary records and guaranteeing timely tax filings are important to support the Company's stability. Spending in staff training and advancement fosters a proficient labor force, promoting advancement and adaptability.Finally, developing clear performance metrics and vital efficiency indicators (KPIs) assists assess service progress and inform calculated changes. By sticking to these best techniques, firms can successfully manage their offshore procedures, ensuring lasting success and sustainability in an affordable international marketplace.

Often Asked Concerns

What Is the Price of Developing an Offshore Company?

The price of more info forming an offshore Company varies extensively relying on jurisdiction, legal requirements, and solutions needed. Normally, costs can range from a few hundred to several thousand dollars, including registration, compliance, and annual charges.

The length of time Does It Require To Develop an Offshore Entity?

The time needed to develop an offshore entity differs substantially, commonly ranging from a few days to numerous weeks (offshore company formation). Variables affecting this duration include jurisdiction, needed paperwork, and the effectiveness of the solution company entailed

Can Individuals Form Offshore Companies Without a Company Partner?

Individuals can indeed form overseas business without a company companion. Several jurisdictions allow single-member entities, empowering business owners to establish and handle their companies individually, while still taking advantage of potential tax advantages and lawful defenses.

Exist Any Type Of Tax Obligation Advantages for Foreign Investors?

What Sort Of Businesses Commonly Utilize Offshore Business?

Offshore firms are regularly made use of by various industries, including shopping, money, and technology. These entities often serve functions such as possession security, tax optimization, and personal privacy, attracting both international companies and specific entrepreneurs. Offshore business have ended up being a focal point in worldwide company discussions due to their unique legal and monetary frameworks. They can operate in several industries including finance, innovation, and trade, offering versatility for worldwide operations.The specifying characteristic of an offshore Company is its capacity to carry out organization internationally while profiting from decreased tax responsibilities and regulative concerns. Furthermore, overseas companies commonly enjoy greater confidentiality, as numerous territories have strict personal privacy regulations shielding the identities of Company proprietors and shareholders.Another significant benefit is property defense. These business can help with global profession, offering simple access to international markets and streamlining cross-border transactions.The versatility in business structure additionally appeals to company owners, as overseas companies can be tailored to fulfill details operational demands. Picking the appropriate jurisdiction is critical for any individual looking to establish up an offshore Company, as it can greatly affect the company's legal commitments, tax obligations, and operational simplicity.

Report this page